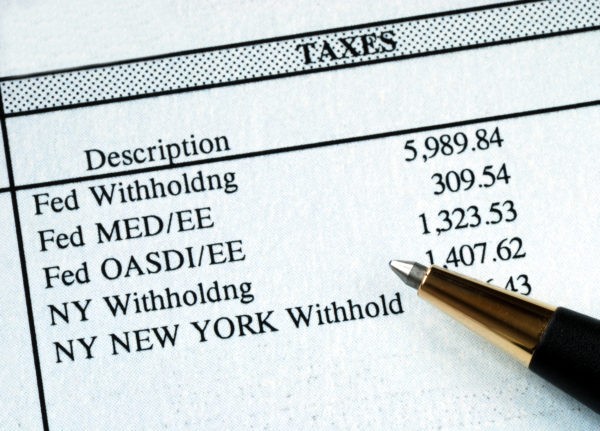

Due to the massive changes in the Tax Cuts and Jobs Act (TCJA), the 2019 filing season resulted in surprises. Some filers who have gotten a refund in past years wound up owing money. The IRS reports that the number of refunds paid this year is down from last year — and the average refund […]

Spring and summer are the optimum seasons for selling a home. And interest rates are currently attractive, so buyers may be out in full force in your area. Freddie Mac reports that the average 30-year fixed mortgage rate was 4.14% during the week of May 2, 2019, while the 15-year mortgage rate was 3.6%. This […]

The gift and estate tax exemption is higher than it’s ever been, thanks to the Tax Cuts and Jobs Act (TCJA), which temporarily doubled the exemption to an inflation-adjusted $10 million ($20 million for married couples who design their estate plans properly). This year, the exemption amount is $11.4 million ($22.8 million for married couples). If you’re married and […]

It’s that time of year when many people who filed their tax returns in April are checking their mail or bank accounts to see if their refunds have landed. According to the IRS, most refunds are issued in less than 21 calendar days. However, it may take longer — and in rare cases, refunds might […]

While the number of plug-in electric vehicles (EVs) is still small compared with other cars on the road, it’s growing — especially in certain parts of the country. If you’re interested in purchasing an electric or hybrid vehicle, you may be eligible for a federal income tax credit of up to $7,500. (Depending on where […]

The pace of health care cost inflation has remained moderate over the past year or so, and employers are trying to keep it that way. In response, many businesses aren’t seeking immediate cost-cutting measures or asking employees to shoulder more of the burden. Rather, they’re looking to “future-focused” health care plan features to encourage healthful […]

Once your 2018 tax return has been successfully filed with the IRS, you may still have some questions. Here are brief answers to three questions that we’re frequently asked at this time of year. Question #1: What tax records can I throw away now? At a minimum, keep tax records related to your return for […]

Charitable giving is a key part of estate planning for many people. If you have a collection of valuable art and are charitably minded, consider donating one or more pieces to receive tax deductions. Generally, it’s advantageous to donate appreciated property to avoid capital gains taxes. Because the top federal capital gains rate for art […]

As an individual, you’ve no doubt been urged to regularly check your credit score. Most people nowadays know that, with a subpar personal credit score, they’ll have trouble buying a home or car, or just getting a reasonable-rate credit card. But how about your business credit score? It’s important for much the same reason — […]

Do you want to save more for retirement on a tax-favored basis? If so, and if you qualify, you can make a deductible traditional IRA contribution for the 2018 tax year between now and the tax filing deadline and claim the write-off on your 2018 return. Or you can contribute to a Roth IRA and […]

If you’re the parent of a child who is age 17 to 23, and you pay all (or most) of his or her expenses, you may be surprised to learn you’re not eligible for the child tax credit. But there’s a dependent tax credit that may be available to you. It’s not as valuable as […]

Some employers reimburse new hires for moving expenses when they relocate. Others reimburse existing employees whose jobs are moved to other locations. Maybe you do both. Now that there’s no tax deduction for moving expenses incurred by individuals, and no more tax-free treatment for employer moving-expense reimbursements, you might wonder: Does it still make sense […]